Stop Printing Money! A Call for a Constitutional Amendment

Stop Printing Money, Inc.

7003 Chadwick Drive, 111

Brentwood, TN 37027

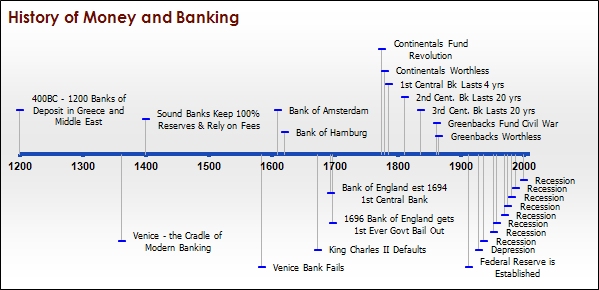

History of Money and Banking

Introduction

America's Founders were well aware of the dangers inherent in fractional reserve banking, central banking and monetizing debt, because they had a perfect example in the Bank of England. They knew that if Congress could monetize debt through a central bank, instead of running the government only on taxes and real borrowing, there would be no limit to the amount of spending they could authorize. That is why in Article 1, Section 8 of the Constitution, Congress was granted only the right "To coin Money, regulate the value thereof, and of foreign Coin, and fix the Standard of Weights and Measures."

If Congress could not create money from nothing, there would be fewer and shorter wars, no booms and busts in the economy, no inflation of any significance, no bail-outs and many other benefits. The current system was designed through a collusion between bankers and politicians so they could manipulate the money supply to their own advantage. But the ability of men to manipulate the system has failed dramatically. This system has allowed Congress to raid the treasure of its citizens without the citizens even knowing they have been robbed. With this system of money, if all debts were paid, we would have no money in the money supply at all. The system is based on debt - and fraud.

How did we come to this?

The first step along the path of understanding is to learn about the goldsmiths, the definition of money, the four types of money and how they came about. This is an important read because you will learn about a truly successful monetary system that lasted for 800 years.

The Banks

The first banks of deposit were established by goldsmiths in Greece ca. 400 BC at the same time coins were developed. Banks were seen in India ca. 315 BC, in Egypt a little later, in Damascus in 1200 and later in Barcelona. Let's take a look at a few successful banks.

The Bank of Venice

Venice is considered the cradle of modern banking. By 1361, many safeguards were in place to ensure the stability of banks. Bankers were forbidden from engaging in other businesses so they would not be tempted to use deposits to finance their own ventures. Their books and stockpile of coins were available for public inspection. Bank examiners were used and banks had to settle accounts between themselves in coin rather than by check. Despite these precautions, Venice's largest bank failed in 1584. However, out of this failure, a truly sound bank rose from the ashes. The new bank was not allowed to make loans and sustained itself solely from fees. Because this worked so well, that bank became the center of Venetian commerce and its receipts were widely accepted even beyond Italy. By 1619, however, the sins of the past were already forgotten and new banks were formed across Europe making loans on fractional reserves. Throughout the 15th and 16th centuries, European banks arose and failed with the inevitable result that depositors lost their money.

The Bank of Amsterdam

The next example of sound banking comes to us from Amsterdam in 1609. Its income came only from fees just like the successful Venetian bank. When the armies of Louis XIV approached in 1672, some worried depositors rushed to the bank to withdraw their money. In reaction, others came in fear their money would not be there. However, once people realized all who wanted their money would be paid, they were no longer worried and left their money in the bank. Eventually, the bank began to lend money it didn't have and it failed in 1819.

The Bank of Hamburg

For over 200 years, the Bank of Hamburg adhered to the principle of 100% reserves. It was so careful and honest, that when Napoleon took possession of the bank in 1813, he found 17,613 more silver marks than were needed to cover liabilities. The French replaced the money with securities, however, and the bank began the practice of fractional reserve banking to survive. It lasted another 55 years before it failed.

The Bank England

The first paper money in England was issued in the early 1600s as fiat money, so it was not widely used. When Charles II was unable to repay a debt of over a million pounds in 1673, 10,000 depositors lost their savings. The ensuing economic disaster resulted in politicians and bankers making a deal to save the economy. Their eventual solution was the first partnership between government and banking to create a central bank which would be granted a monopoly to issue bank notes as the sole currency of England. The Bank of England, chartered in 1694, would use debt monetization at the direction of Parliament to create money out of nothing and the economy would be "saved," albeit at the expense of the treasure of the people. In 1696, there was a run on the bank and it did not have the money to pay depositors. Parliament intervened exempting the bank from having to honor its contract to pay in gold, beginning a tradition of bail outs that has continued to this day. In 1833, the bank's notes became legal tender, meaning people had to use them to settle debts and pay taxes. While Parliament granted charters to other banks that failed, they have always bailed out the Bank of England by monetizing debt and devaluing the currency. This bank was the example our founders had when they wrote the Constitution, so they could easily point to the dangers of banking in this way.

The Rothschild

Mayer Amschel Rothschild (1744 - 1812) once said, "Let me issue and control a nation's money and I care not who writes the laws." Son of a goldsmith, he apprenticed as a banker and quickly worked his way from clerk to junior partner, eventually establishing his own banking business in the 1760s. He also traded in rare coins, garnering the favor of wealthy patrons including William of Hess. His banking skill and connections led to the family handling William's very profitable troop rental business providing Hessian soldiers to many including Britain for the revolution in America. A bank was established for his son Nathan in London and as business grew, each of his sons headed his own branch of the family banking dynasty in Berlin, Vienna, Paris and Naples. The Rothschilds financed everything from South African diamond fortunes to governments and the crown heads of Europe. They financed both sides of many wars, allowing them a monopoly to also smuggle cargo and information across battle lines.

In 1815, England was selling bonds at an incredible rate to fight the war with Napoleon. As the battle of Waterloo approached, England's currency and entire future was at risk pending the outcome. In the early morning hours of June 20, Nathan Rothschild's agent reported the outcome of the battle to him a full 24 hours before Wellington's own courier arrived with the news. The members of the London stock exchange expected Nathan to know the outcome of the battle before anyone else, so when he began selling British bonds, everyone began selling and a panic ensued. When the market was a fraction of its original value, Nathan quickly bought the entire market for pennies on the dollar and in a single day became owner of a dominant portion of England's debt. In a similar move three years later, the Rothschilds gained similar control over the French economy.

The Rothschilds were among the first and remain today some of the most powerful international bankers in the world who use fractional reserve practices and debt monetization through governments to increase their own fortunes and power at the expense of the people. They were instrumental by proxy, in the creation of the Federal Reserve in 1913.

America & Central Banking

In 1775, the money supply was $12 million and paper Continentals were traded for $1 in gold. The Continental Congress didn't have the authority to tax, so it authorized $2 million in additional paper to be printed in June of that year, another million shortly thereafter and $3 million more before the end of the year. In 1776, another $19 million was printed, in 1777, another $13 million, in 1778, another $64 million and in 1779, $125 million. The Continental Army issued certificates for another $200 million for the purchase of supplies. At the same time the states were doing the same thing. The total estimate is a 5,000% increase in the money supply in 5 years with nothing backing it. By 1779, Continentals were worth less than a penny and the phrase "not worth a Continental" was born. A pair of shoes cost $5,000 and a suit of clothes, $1,000,000. This debt was not paid for by future generations. It was paid for by that generation because they themselves experienced the inflation. This is the effect of fiat money. Had it not been for the personal intervention of George Washington, the army would have revolted against the Congress and the revolution would have ended in anarchy.

The 1st Central Bank - The Bank of North America, 1781-1785

The first central bank of the United States was chartered even before the Constitution was adopted. Robert Morris, a wealthy merchant and Congressman and eventual signer of the Declaration of Independence was made Superintendent of Finance to organize the bank. It was modeled after the Bank of England, but did not establish legal tender. It was to be capitalized with $400,000, but only about $70,000 was raised from private sources. The bank was further capitalized with gold loaned by France to America and other capital and opened in 1782. The bank handled the account for Congress and quickly loaned them $1,200,000. Amid charges of fictitious credit, foreign influence and unfair competition, the bank's charter was revoked in 1785.

The 2nd Central Bank - The Bank of the United States, 1791-1811

Jefferson argued against the constitutionality of a central bank, but George Washington eventually sided with Alexander Hamilton and the second central bank of the United States was granted a twenty year charter in 1791. It was much like the first bank and the Bank of England in that it could issue notes and handled the government's account. This bank was required to redeem notes in gold or silver on demand but since it was not required to keep gold or silver in its vaults equal to its note obligations that was not possible. The bank was supposed to have $10,000,000 in capital but it began operations at around $675,000, less than one tenth of that requirement. The Bank of the United States was established to loan money to the federal government. Private loans were secondary since it was not allowed to charge more than 6% interest. The government was required to invest $2,000,000 of the $10,000,000 required reserves at the start. It invested the $2,000,000, but took it back out and borrowed $8,200,000 over the next five years. In that five year period, wholesale prices rose 72%. The bank was a source of political disagreement nearly from its inception, but even so, its charter was not renewed in 1811 by a single vote in Congress.

The 3rd Central Bank - The Second Bank of the United States, 1816-1836

This bank was a carbon copy of the others. It was required to raise $7 million in gold and pay Congress a $1.5 million fee for the charter. By the second year it had only raised $2.5 million, much of it foreign investment. Loose monetary policy resulted in a boom, bust economic cycle. It has been speculated that taxpayers lost 40% of their wealth during this period.

The Case for Constitutionality of Central Banking

The court case that upheld central banking was presided over by Chief Justice John Marshall, who was a federalist and an advocate of strong, centralized government. The case was McCulloch V. Maryland, decided in 1819. The argument was not made upon whether Congress had the power directly or indirectly to emit bills of credit or otherwise convert debt into money. If that argument had been made the issue, it would have been unconstitutional. But the focus of the case was on a "necessary and proper means" for Congress to execute any other constitutional powers it may have. The bottom line is the case was a fraud in that it is quite likely the Plaintiff in the case did NOT want to win, but only to lose and set a precedent for the government to operate a central bank. The public did not agree with the case. Rather, they agreed with Jeffersonian Republicans and sound money principles, but by then that party had abandoned those principles so a new party was formed by Martin Van Buren and Andrew Jackson. It was the Democratic Party and its main agenda item was to abolish the Second Bank of the United States. Jackson was elected to the Presidency in 1828 and it took him 8 years to do that, but he was successful.

Nicholas Biddle was the President of the Second Bank of the United States. In 1832, the bank's charter had four more years, but Biddle decided to ask Congress to renew it early so the decision would come just before Jackson's reelection. Biddle figured Jackson would not take a controversial position to oppose the bank. But Jackson put his entire political future on the line and vetoed the bill with three general arguments against it.

- injustice inherent in granting a government monopoly to the bank.

- the unconstitutionality of the bank even if it were not unjust and

- the danger to the country in having the bank heavily dominated by foreign investors.

Regarding the constitutionality, Jackson did not believe he had to abide by the McCulloch V. Maryland decision of the Supreme Court because the President and Congress have just as much a right to decide constitutionality as the court. That was not a novel view at the time. It is only in recent times that people think the Supreme Court is the only entity of our government authorized to pass on the question of constitutionality. He declared the bank unconstitutional in his veto and had every right to do so according to the founding fathers division of power concept adopted in the Constitution.

While Jackson was fighting the bank, it intentionally shrunk the nation's money supply to cause a financial crisis. This intentional act was discovered by the Governor of Pennsylvania where the bank was located. What had been a close fight between the bank and the President ended up becoming a landslide for the President. Jackson completely paid off the national debt and gave $35 million back to the states for a wide variety of public works projects.

Era of No Central Banking and the Civil War

After Jackson closed the 2nd Bank of the US in 1836 and before the Civil War, only states could charter banks. However, abuse of fractional reserve banking and poor oversight led to extensive bank closings during this period and significant loss of money by depositors. A few banks took on some functions of a central bank during this time acting as clearing houses and providing deposit insurance.

In 1861, federal expenses were $67 million. After a year of war, they were $475 million and by 1865, $1.3 billion. Taxes covered only 11% of the total and by the end of the war the deficit was $2.61 billion. Since taxes couldn't cover the amount and there was no central bank to bail the government out, they turned to the Rothschilds who loaned the North the needed funds. The Rothschilds also put money in bonds in Southern banks, but these had fallen to almost zero value so in familiar fashion, they bought the bonds back for pennies on the dollar and planned to have the North force the South to pay them off in full at the end of the war. Even after the sale of bonds, the North needed more money or would have to stop fighting. In direct contradiction to Article 1, Section 10's prohibition of bills of credit, Lincoln printed $150 million worth of fiat money. The notes were printed with green ink and became known as "Greenbacks." Voters were promised that this was a "one time" measure but by the end of the war, $432 million in Greenbacks had been issued.

As might be guessed the purchasing power of Greenbacks fell by 65% while the money supply increased by 138%. Americans surrendered half the money they earned during that period to inflation (from debt monetization) in addition to their taxes.

The expense of funding the Civil War precipitated the National Bank Acts of 1863 through 1865 establishing federally chartered banks and granting them significant power over the monetary system. The banks had a monopoly on the issuance of bank notes which the government accepted for payment of taxes. They could back this money up to 90%, with government bonds instead of gold. Every bank in the system had to accept the notes regardless of how shaky the bank. This was like a half-way house to central banking. Andrew Jackson had killed the Second Bank of United States, but the legislature effectively put the same functionality back in place with this fractional reserve system. Lincoln wanted to veto the bank act, but was unable to buck his party during time of war. Nevertheless, he was troubled by it and wrote about his concerns.

The citizens did not revolt because they didn't understand the burden of a hidden tax just as we do not understand it today. But bankers were laughing at the voters. On June 25, 1863, four months after the National Bank Act, a confidential letter was sent from the Rothschild Investment house in London to an associate banking firm in New York.

"The few who understand the system [bank loans earning interest and also serving as money] will either be so interested in its profits or so dependent upon its favors that there will be no opposition from that class while, on the other hand, the great body of people, mentally incapable of comprehending, ... would bare its burden without complaint."

The 4th Central Bank - The Federal Reserve

Prior to WWII East coast businesses were doing well and were funding growth out of profits rather than taking out loans. Banks in the west were flourishing with growth and taking deposits from east coast banks. The government was flush with money and was paying off its debt as well. None of this was beneficial to East coast bankers, who could foresee the need for bailouts looming on the horizon. They knew the best way to accomplish this was through a central bank.

At the turn of the 20th century, US wealth was held mainly by the Morgan group and the Rockefeller group. Europe's wealth was held by the Rothschild group and the Warburg group. For nine days in November of 1910, seven financiers, one of whom was also a politician, met in secret on Jekyll Island, Georgia to outline the plans for a fourth central bank. The Jekyll Island Club, as they became known, represented one sixth of the world's wealth. They were:

- Nelson Aldrich, Rhode Island Senator (R), JP Morgan associate, son-in-law was John D. Rockefeller, Jr.

- Abraham Piatt Andrew, Assistant Secretary of the U.S. Treasury

- Frank A. Vanderlip, President of National City Bank of New York, representing William Rockefeller and Kuhn & Loeb & Company

- Henry P. Davison, Senior Partner with JP Morgan

- Charles D. Norton, President of JP Morgan's First National Bank of New York

- Benjamin Strong, head of JP Morgan's Bankers Trust Company

- Paul M. Warburg, Kuhn & Loeb partner, representing the Rothschilds, brother of Max Warburg, head of the Warburg banking consortium

The five purposes of the 1910 meeting were to:

- Stop the growing competition from the nation's newer banks, located generally in the West.

- Obtain a franchise to create money out of nothing for the purposes of lending.

- Get control of the reserves of all banks so the more reckless ones would not be exposed to currency drains and bank runs.

- Get the taxpayer to pick up the cartel's inevitable losses, via "bail outs.

- Convince Congress that the purpose was to protect the public.

It is important to note that this was not a conspiracy. A conspiracy requires the planning of a crime. After the anti-trust acts of 1934, such a meeting would have been against monopoly laws, but it was not criminal in 1910. The seven men on Jekyll Island were bankers and monetary scientists. They were developing a business plan to have taxpayers as a fail-safe to rescue their businesses by the workings of a fourth central bank. As with most business plans they maintained secrecy until the bill was passed on December 22, 1913, but several of them in later years published what occurred at the meeting.

In 1910, Senator Aldrich proposed the "Aldrich Bill" to create the fourth central bank. This bill never made it out of committee, but it laid the groundwork for the nearly identical Democrat "Glass-Owen Bill" that would pass two years later with the support of Woodrow Wilson. The country had its fourth central bank in the form of the US Federal Reserve. The bank had the right to

- convert federal debt into money (or monetize debt)

- lend that money to the government with interest

- control the affairs of regional banks

- be the depositor of federal funds

- create the official money of the United States.

It was the first time that a US bank could issue paper notes that were legal tender not only for public debts but for private ones as well. As with much legislation today, the Federal Reserve Act left out many details and was written in vague language. This was a tactical move to avoid debate over fine points, get the bill passed and allow flexibility for future interpretation. Since the bill was passed, it has been amended 195 times and would be virtually unrecognizable to the Congressmen and Senators who voted for it in 1913.

The first real test of the new system was WWI. 30% of the war was paid for by taxes and 70% was paid through inflation by monetizing debt. After the war, in order to help England out of its financial troubles and counteract a mild recession in 1927, the Fed artificially lowered rates and pumped money into the US economy while England raised theirs to attract investment. Gold which had moved from England to America during the war, moved back to England as planned, but the world economies were nearly ruined in the process. The abundance of available money in the market caused malinvestment and speculation eventually crashing the economy when the true value of the investments was recognized.

The Great Depression

On August 9, 1929, the Fed reversed its easy money policy in concert with the Bank of England and began selling securities which severely contracted the money supply. The market topped out on September 19, 1929 and people began to purchase stock on the way down. On Thursday October 24th, the market turned and thousands of investors stampeded to sell. Thirteen million shares were sold. People thought the bottom had dropped out of the market, but they were wrong. On Tuesday October 29th, the market failed. Within a day millions of investors were wiped out. Within a few weeks, three billion dollars of wealth had disappeared. Within twelve months, $40 billion had been wiped out. The inability of man to control market forces was proven. With the help of ill-advised government policy such as the Smoot Hawley tariff of 1930 and many others, the resulting depression lasted longer than anyone anticipated.

Results of the Fed as a Central Bank

It has been said that the Fed was born as a stabilizing force out of the panic of 1907, but clearly the other reasons we have discussed are more appropriate. Certainly, the Fed has been more successful at bailouts and creating money for government spending than it has been at stabilizing the economy. Since it was formed, the Fed has presided over crashes and recessions in 1921, 1929, 1937, 1953, 1957, 1969, 1975, 1981, 1987, 2000 and 2008. We have experienced some 1000% inflation since the inception of the Fed in 1913, which has destroyed 90% of the purchasing power of the dollar. This loss in value was quietly transferred from the citizens to the government through inflation and the Federal Reserve is the mechanism by which it was accomplished.

The Crisis of 2008

The root causes of the 2008 financial crisis / correction can be found in easy monetary policy at the Fed and the Community Reinvestment Act initiated by President Carter, given teeth by President Clinton and encouraged by President GW Bush. Fannie Mae and Freddie Mac were used to encourage home ownership by those who could not afford the cost. Low interest rates contributed to the resulting bubble and an enormous excess of bad loans ended up on the books of most banks, especially the large banks that knew they would get bailed out. In order to lay off the risk, these loans were bundled into financial instruments that masked their risk profiles and sold to off. Eventually, when the true value of those instruments was revealed, the crisis was triggered.